Beginning January 1, 2020, all shipments to Brazil must include the recipient’s Tax ID number on both the customs declarations and shipping labels. Brazil is implementing this new requirement to help ensure taxes are collected from resellers who purchase U.S. goods and resell them within Brazil at a profit. If you are selling to customers in Brazil it is essential that you collect their Tax ID at the time of sell—shipments missing the recipient’s Tax ID will be subject to return, or even disposal, by Brazilian Customs.

Shipping and Customs Requirements

Regardless of mail class, the recipient’s Tax ID must be visible on the shipping label and declared within the appropriate customs form. There are several Tax IDs that can be used when shipping to Brazil, including:

- CPF – Individual Tax ID (format: 000.000.000-00)

- CNPJ – Business Tax ID (format: 00.000.000/0000-00)

- Passport Number

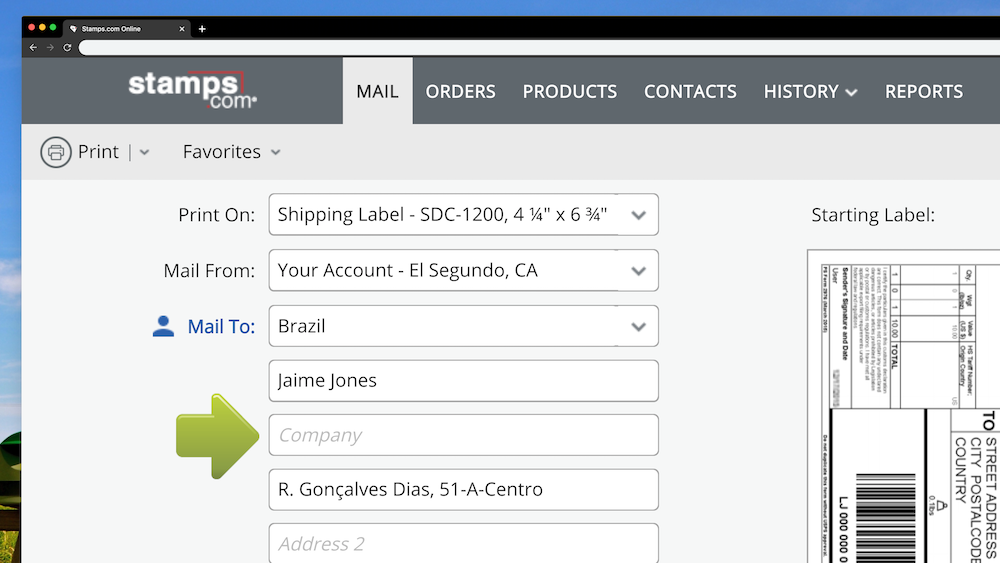

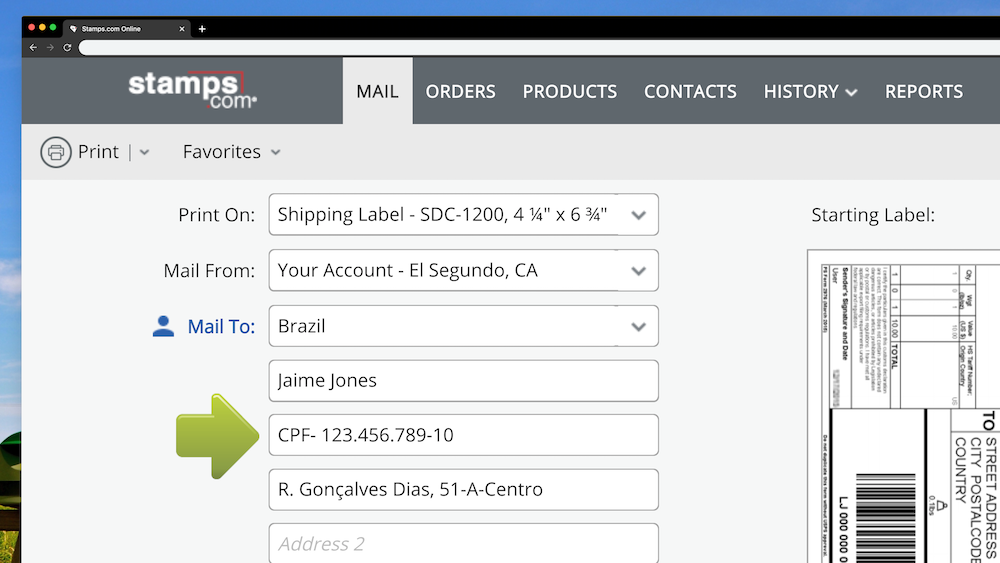

Shipping to Brazil with Stamps.com Online

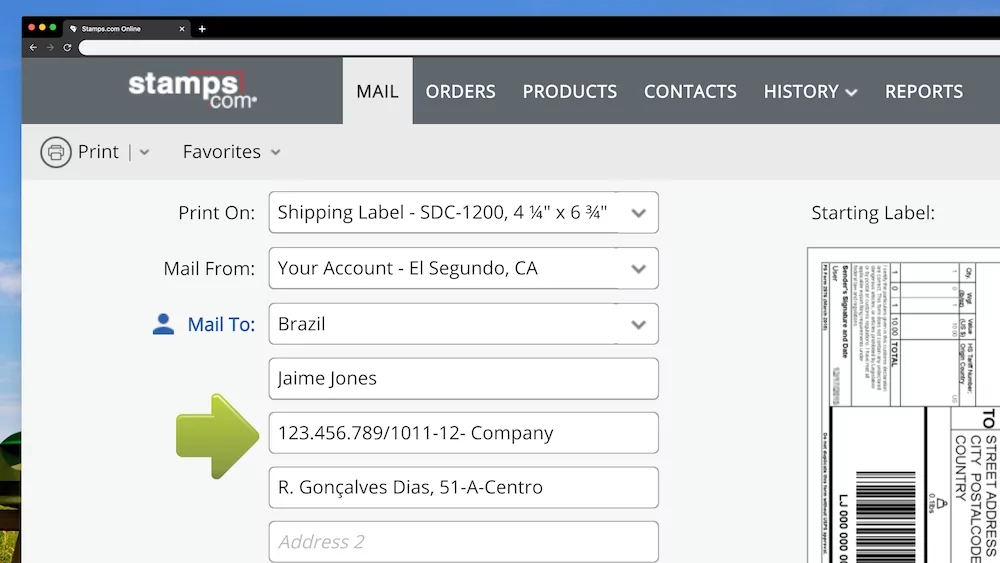

If you are a Stamps.com customer, adding a Tax ID to your Brazilian shipment is simple. Typically when shipping to an individual in Brazil, the company field is left blank:

You can use this field to enter your recipient’s Tax ID. We recommend using the prefix “CPF-” to indicate that you are using an Individual Tax ID.

If you are shipping to a business, enter the customer’s Business Tax ID, followed by a slash and their business name.

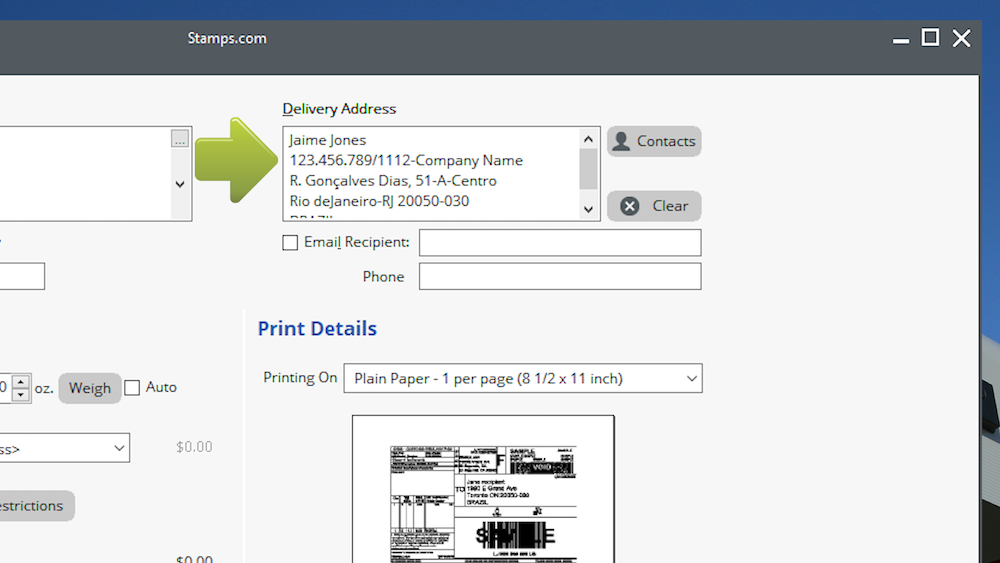

Shipping to Brazil with Stamps.com Windows Software

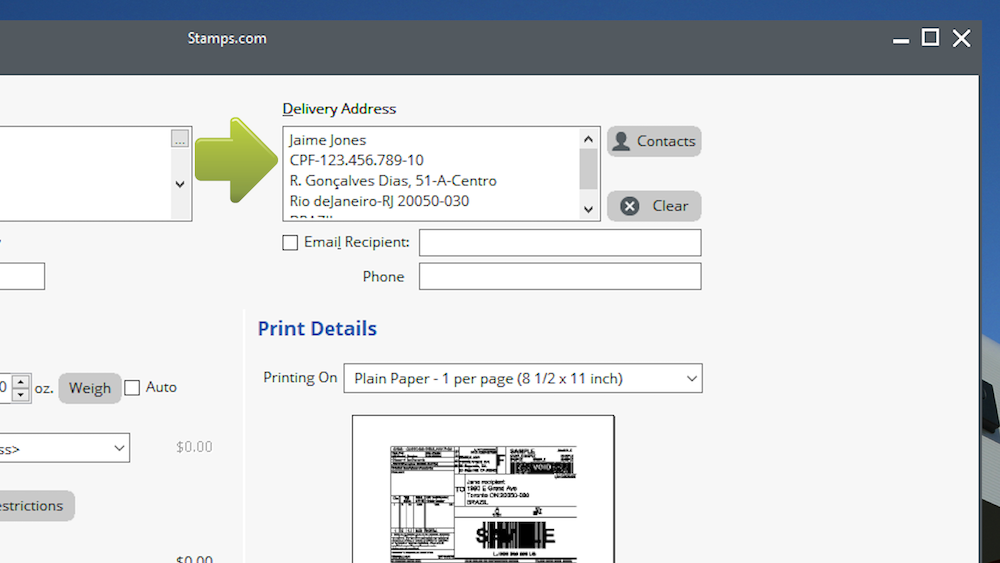

If you use the Stamps.com Windows software the process of adding a Tax ID to your shipment is just as easy. Within the International Tab of the software simply include the recipient’s Tax ID in the Delivery Address field under the recipient’s name.

For Individual Tax IDs use the format “CPF-” followed by the ID number:

For Businesses enter the customer’s Business Tax ID, followed by a slash and their business name: