Stamps.com Reports Fourth Quarter And Fiscal 2017 Results

EL SEGUNDO, Calif.‑‑(BUSINESS WIRE)‑‑Feb. 21, 2018‑‑ Stamps.com® (NASDAQ: STMP), the leading provider of postage online and shipping software solutions to over 725 thousand customers, today announced results for the fourth quarter and fiscal year ended December 31, 2017.

Fourth Quarter 2017 Financial Highlights

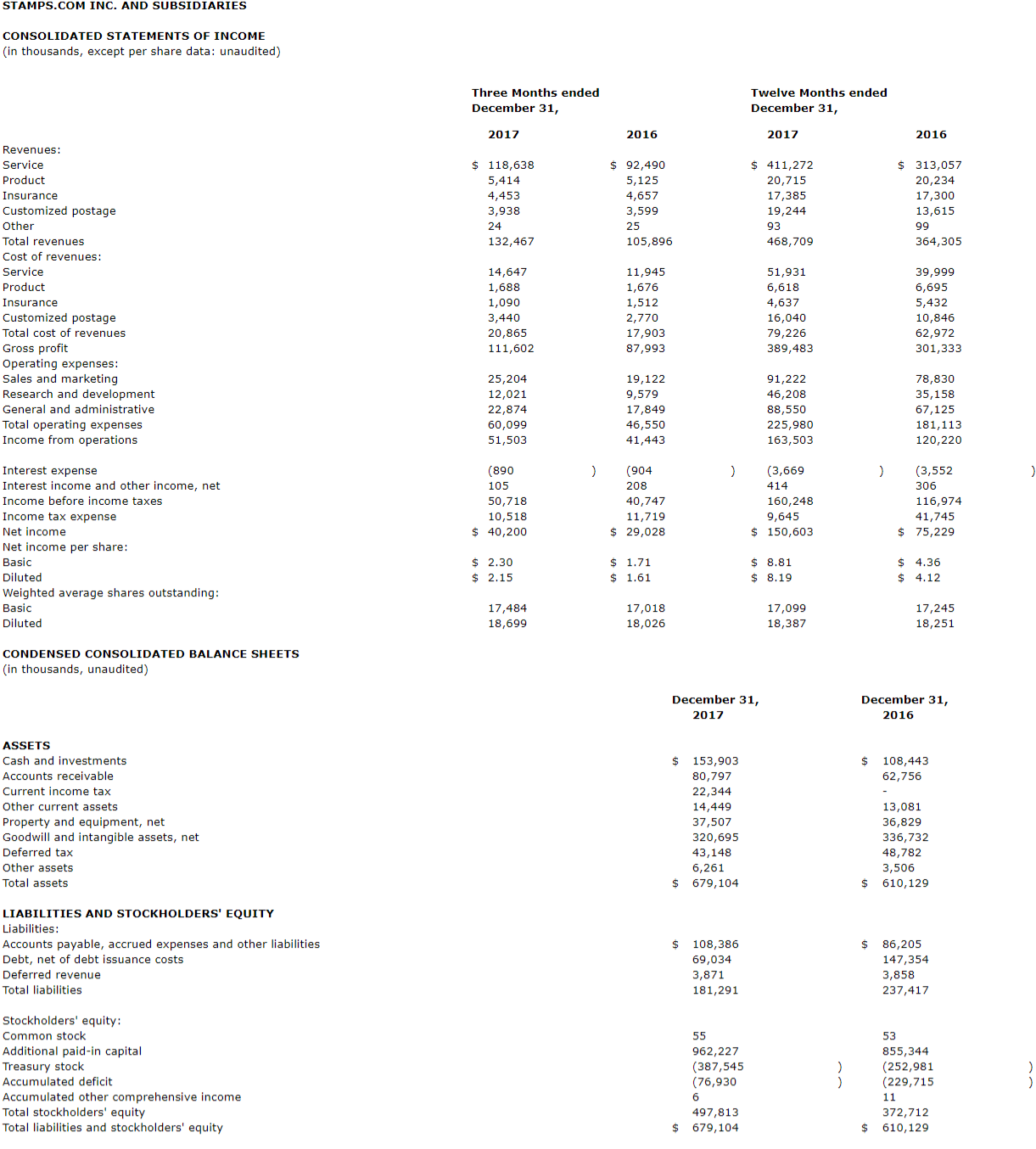

- Total revenue was $132.5 million, up 25% compared to $105.9 million in the fourth quarter of 2016.

- GAAP net income was $40.2 million, up 38% compared to $29.0 million in the fourth quarter of 2016.

- GAAP net income per fully diluted share was $2.15, up 34% compared to $1.61 in the fourth quarter of 2016.

- Non‑GAAP adjusted EBITDA was $64.1 million, up 15% compared to $55.9 million in the fourth quarter of 2016.

- Non‑GAAP adjusted income per fully diluted share was $4.68, up 71% compared to $2.73 in the fourth quarter of 2016.

“We are pleased with our fourth quarter and fiscal 2017 financial performance,” said Ken McBride, Stamps.com’s Chairman and CEO. “We achieved strong financial results driven by exceptional performance in our shipping business. We believe we are well positioned for 2018 and we remain excited about our long‑term business opportunities.”

Fourth Quarter 2017 Detailed Results

Fourth quarter 2017 total revenue was $132.5 million, up 25% compared to the fourth quarter of 2016. Fourth quarter 2017 Mailing and Shipping revenue (which includes service, product and insurance revenue but excludes Customized Postage and Other revenue) was $128.5 million, up 26% versus the fourth quarter of 2016. Fourth quarter 2017 Customized Postage revenue was $3.9 million, up 9% versus the fourth quarter of 2016.

Fourth quarter 2017 GAAP income from operations was $51.5 million, GAAP net income was $40.2 million and GAAP net income per share was $2.15 based on 18.7 million fully diluted shares outstanding. This compares to fourth quarter 2016 GAAP income from operations of $41.4 million, GAAP net income of $29.0 million and GAAP net income per share of $1.61 based on 18.0 million fully diluted shares outstanding. Fourth quarter 2017 GAAP income from operations, GAAP net income and GAAP income per fully diluted share increased by 24%, 38% and 34% year‑over‑year, respectively.

Fourth quarter 2017 GAAP income from operations included $7.2 million of non‑cash stock‑based compensation expense and $4.0 million of non‑cash amortization of acquired intangibles. Fourth quarter 2017 GAAP net income also included $93 thousand of non‑cash amortization of debt issuance costs. Fourth quarter 2017 GAAP income tax expense was $10.5 million and non‑GAAP income tax benefit was $25.5 million resulting in a $36.0 million non‑GAAP tax benefit adjustment. The non‑GAAP tax benefit adjustment primarily reflects the tax impact from reconciling the projected 2017 non‑GAAP effective tax rates used for the prior three quarters of 2017 to the actual non‑GAAP effective tax rate for fiscal year 2017. See the section later in this press release entitled “About Non‑GAAP Financial Measures” for more information on how non‑GAAP taxes are calculated. Excluding the non‑cash stock‑based compensation expense and non‑cash amortization of acquired intangibles, fourth quarter 2017 non‑GAAP income from operations was $62.7 million. Also excluding non‑cash amortization of debt issuance costs and including the non‑GAAP tax benefit adjustment, fourth quarter 2017 non‑GAAP adjusted income was $87.5 million or $4.68 per share based on 18.7 million fully diluted shares outstanding.

Fourth quarter 2016 GAAP income from operations included $9.2 million of non‑cash stock‑based compensation expense and $4.0 million of non‑cash amortization of acquired intangibles. Fourth quarter 2016 GAAP net income also included $93 thousand of non‑cash amortization of debt issuance costs and $6.9 million of non‑cash income tax expense. Excluding the non‑cash stock‑based compensation expense and non‑cash amortization of acquired intangibles, fourth quarter 2016 non‑GAAP income from operations was $54.6 million. Also excluding non‑cash amortization of debt issuance costs and non‑cash income tax expense, fourth quarter 2016 non‑GAAP adjusted income was $49.2 million or $2.73 per share based on 18.0 million fully diluted shares outstanding.

Therefore, fourth quarter 2017 non‑GAAP income from operations, non‑GAAP adjusted income and non‑GAAP adjusted income per fully diluted share increased by 15%, 78% and 71% year‑over‑year, respectively.

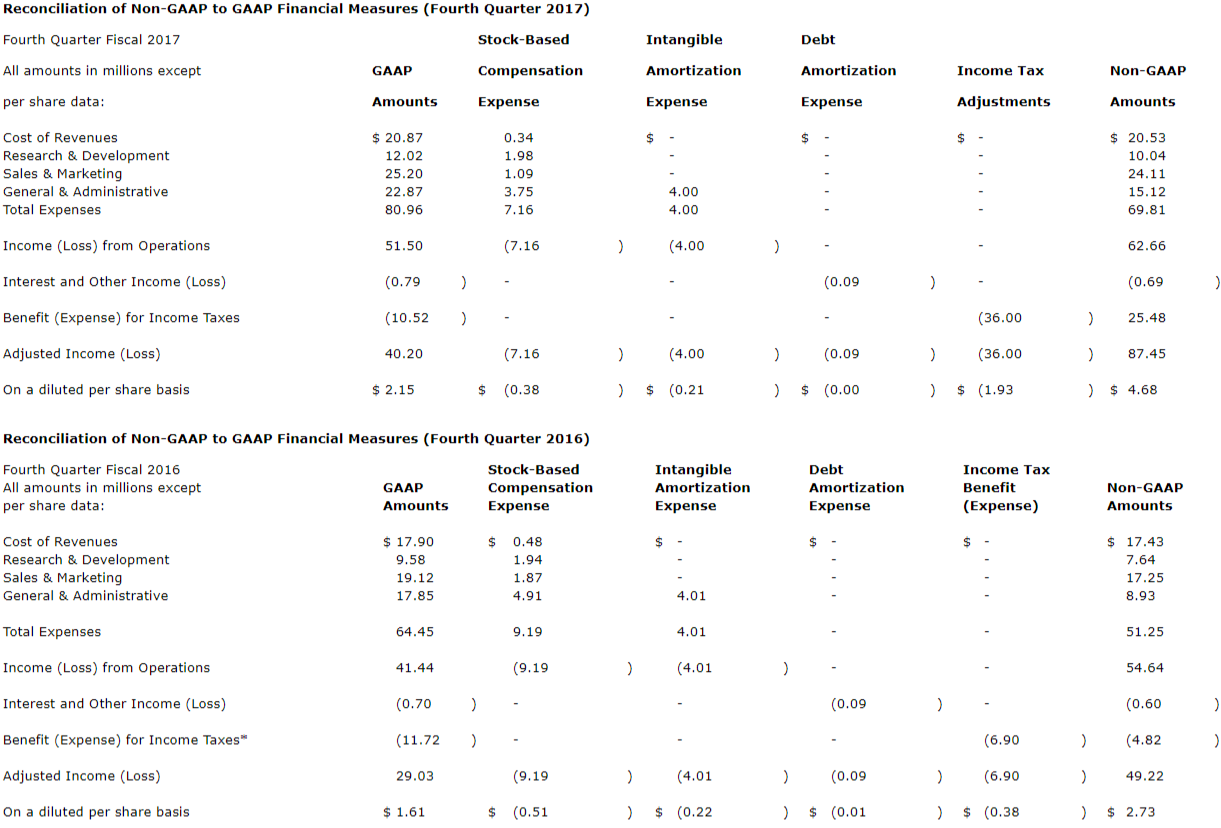

Non‑GAAP income from operations, non‑GAAP adjusted income and non‑GAAP adjusted income per share are described further in the “About Non‑GAAP Financial Measures” section of this press release and are reconciled to the corresponding GAAP measures in the following tables (unaudited):

* For the fourth quarter 2016, the Company incurred approximately $6.9 million in deferred income tax expense based on its GAAP income measures. In addition, the Company would have incurred an additional approximately $2 million of deferred income tax expense based on its non‑GAAP income measures.

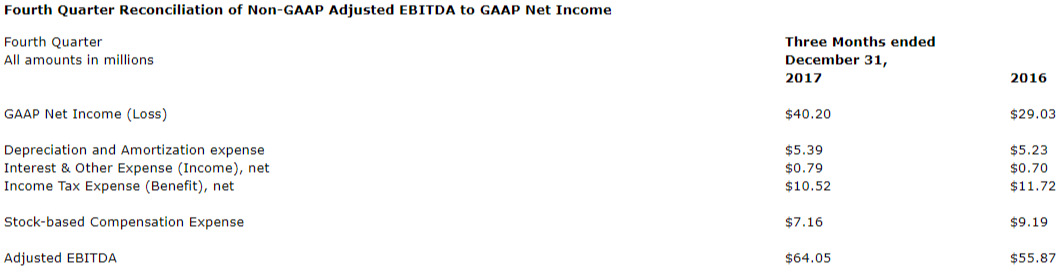

Fourth Quarter GAAP Net Income and Non‑GAAP Adjusted EBITDA

Fourth quarter 2017 GAAP net income was $40.2 million, up 38% compared to $29.0 million in the fourth quarter of 2016.

Fourth quarter 2017 non‑GAAP adjusted EBITDA was $64.1 million, up 15% compared to $55.9 million in the fourth quarter of 2016.

Adjusted EBITDA is a non‑GAAP financial measure which is described further in the “About Non‑GAAP Financial Measures” section of this press release and is reconciled to GAAP net income in the following table (unaudited):

2017 Detailed Results

2017 total revenue was $468.7 million, up 29% compared to 2016. 2017 Mailing and Shipping revenue (which includes service, product and insurance revenue but excludes Customized Postage and Other revenue) was $449.4 million, up 28% versus 2016. 2017 Customized Postage revenue was $19.2 million, up 41% versus 2016.

2017 GAAP income from operations was $163.5 million, GAAP net income was $150.6 million and GAAP net income per share was $8.19 based on 18.4 million fully diluted shares outstanding. This compares to a 2016 GAAP income from operations of $120.2 million, GAAP net income of $75.2 million and GAAP net income per share of $4.12 based on fully diluted shares outstanding of 18.3 million. 2017 GAAP income from operations, GAAP net income and GAAP income per fully diluted share increased by 36%, 100%, and 99% year‑over‑year, respectively.

2017 GAAP income from operations included $40.8 million of non‑cash stock‑based compensation expense, $16.0 million of non‑cash amortization of acquired intangibles, $6.0 million of executive consulting expense, and $1.9 million of one‑time insurance proceeds relating to a prior legal settlement. 2017 GAAP net income also included $374 thousand of non‑cash amortization of debt issuance costs. 2017 GAAP income tax expense was $9.6 million and non‑GAAP income tax expense was $13.3 million resulting in a non‑GAAP tax expense adjustment of $3.7 million. The non‑GAAP tax expense adjustment primarily reflects the tax impact from higher non‑GAAP income as compared to GAAP income at the effective tax rate for fiscal 2017. See the sections later in this press release entitled “About Non‑GAAP Financial Measures” for more information on how non‑GAAP taxes are calculated. Excluding the non‑cash stock‑based compensation expense, non‑cash amortization of acquired intangibles, executive consulting expense, and one‑time insurance proceeds, 2017 non‑GAAP income from operations was $224.5 million. Also excluding non‑cash amortization of debt issuance costs and including the non‑GAAP tax expense adjustment, 2017 non‑GAAP adjusted income was $208.2 million or $11.33 per share based on 18.4 million fully diluted shares outstanding.

2016 GAAP income from operations included $33.9 million of non‑cash stock‑based compensation expense, $14.6 million of non‑cash amortization of acquired intangibles, and $1.1 million of expenses related to the ShippingEasy acquisition. 2016 GAAP net income also included $374 thousand of non‑cash amortization of debt issuance costs and $33.6 million of non‑cash income tax expense. Excluding the non‑cash stock‑based compensation expense, non‑cash amortization of acquired intangibles, and acquisition related expenses, 2016 non‑GAAP income from operations was $169.8 million. Also excluding non‑cash amortization of debt issuance costs and non‑cash income tax expense, 2016 non‑GAAP adjusted income was $158.8 million or $8.70 per share based on 18.3 million fully diluted shares outstanding.

Therefore, 2017 non‑GAAP income from operations, non‑GAAP adjusted income and non‑GAAP adjusted income per fully diluted share increased by 32%, 31% and 30% year‑over‑year, respectively.

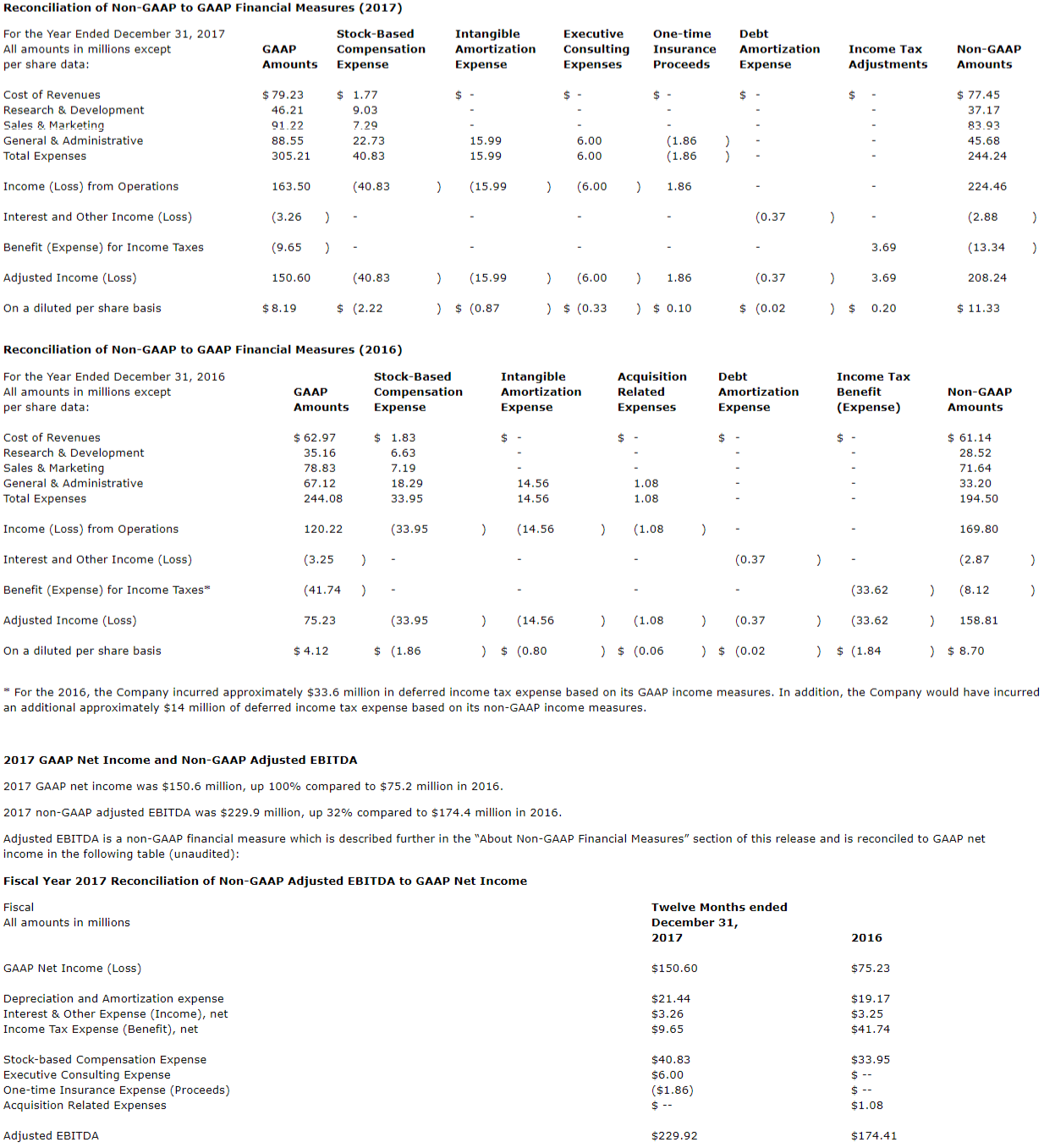

Non‑GAAP income from operations, non‑GAAP adjusted income and non‑GAAP adjusted income per share are described further in the “About Non‑GAAP Financial Measures” section of this press release and are reconciled to the corresponding GAAP measures in the following tables (unaudited):

Taxes

In the first quarter of 2017, the Company adopted Accounting Standards Update No. 2016‑09, Compensation‑Stock Compensation (Topic 718): Improvements to Employee Share‑Based Payment Accounting (ASU 2016‑09), which requires us, among other items, to record excess tax benefits as a reduction of the provision for income taxes in the income statements, whereas they were previously recognized in equity. The impact of adoption has been reflected in our income statement for the period ended December 31, 2017.

For 2017, the Company reported a GAAP income tax expense of $9.6 million representing an effective tax rate of 6.0%. For 2016, the Company reported a GAAP income tax expense of $41.7 million representing an effective tax rate of 35.7%. The lower effective GAAP tax rate in 2017 was primarily related to the tax benefits resulting from higher employee stock option exercises in 2017 and the associated change in accounting treatment under ASU 2016‑09. Our fiscal year 2017 GAAP net income should also be understood to have been positively impacted by the lower effective tax rate resulting primarily from employee stock option exercises and the associated change in accounting treatment under ASU 2016‑09. The 2017 GAAP effective tax rate of 6.0% should not be assumed to apply for 2018 as employee stock option exercises are inherently unpredictable and actual 2018 employee stock option exercises could differ materially from those in 2017 which could have a material impact on our 2018 effective tax rate as compared to 2017.

Share Repurchase and Debt Repayment

During the fourth quarter of 2017, the Company repurchased approximately 169 thousand shares at a total cost of approximately $30.6 million. During 2017, the Company repurchased approximately 988 thousand shares at a total cost of approximately $133.7 million.

On October 24, 2017, the Board of Directors approved a new share repurchase program, which became effective on November 10, 2017 and authorized the Company to repurchase up to $90 million of stock over the six months following its effective date.

During the fourth quarter of 2017, the Company made a required principal repayment of $2.1 million and an optional principal repayment of $62.0 million against the borrowings under the Company’s existing credit agreement related to the Endicia acquisition. As of December 31, 2017, total debt under the credit agreement excluding debt issuance costs was $70.1 million.

Summary of our Business Outlook

For fiscal year 2018, the Company currently expects its GAAP financial outlook to be as follows:

- We expect total 2018 revenue to be in a range of approximately $530 million to $560 million.

- We expect GAAP net income to be in the range of approximately $138 million to $153 million.

- We expect GAAP net income per fully diluted share to be in a range of approximately $7.09 to $8.04.

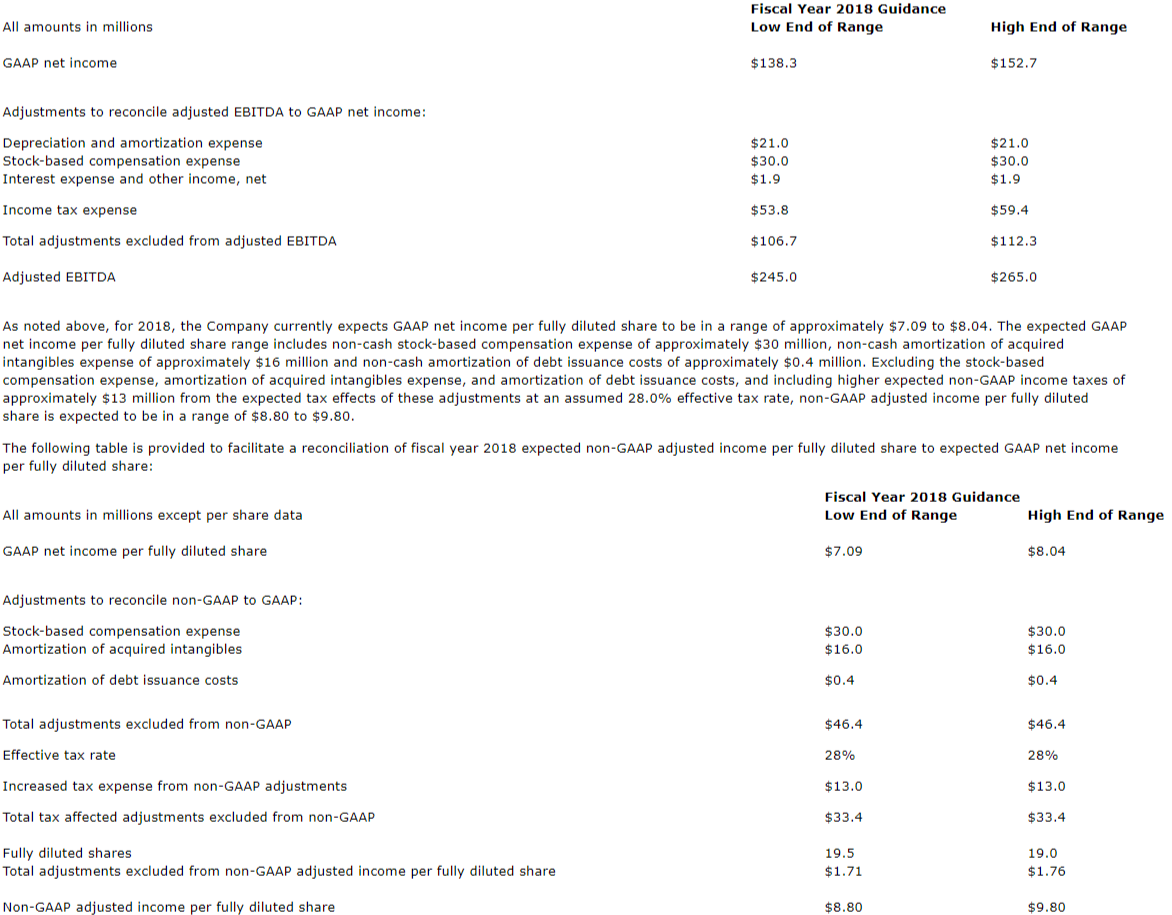

The above GAAP numbers adjusted as detailed below result in the following non-GAAP financial outlook:

- We expect non‑GAAP adjusted EBITDA to be in a range of approximately $245 million to $265 million.

- We expect non‑GAAP adjusted income per fully diluted share to be in a range of $8.80 to $9.80.

Detailed Discussion of our Business Outlook

As noted above, for 2018, the Company currently expects total revenue to be in a range of approximately $530 million to $560 million.

Also, for 2018, the Company currently expects GAAP net income to be in a range of approximately $138 million to $153 million.

The expected GAAP net income range includes depreciation and amortization expense of approximately $21 million, stock‑based compensation expense of approximately $30 million, interest expense and other income, net of approximately $2 million and income tax expense of approximately $54 million to $59 million. Excluding the depreciation and amortization expense, stock‑based compensation expense, interest expense and other income, net and income tax expense, we expect non‑GAAP adjusted EBITDA to be in a range of approximately $245 million to $265 million.

The following table is provided to facilitate a reconciliation of 2018 expected non‑GAAP adjusted EBITDA to expected GAAP net income:

This business outlook does not include the impact from potential future acquisitions, including acquisition costs or related financings, or unanticipated events. This business outlook and the related assumptions are forward‑looking statements subject to the safe harbor statement contained at the end of this press release, and reflect our views of current and future market conditions. Ranges represent a set of likely assumptions, but actual results could fall outside the range presented. Only a few of our assumptions underlying our guidance are disclosed above, and our actual results will be affected by known and unknown risks, trends, uncertainties and other factors, some of which are beyond our control or ability to predict. Although we believe that the assumptions underlying our guidance are reasonable, they are not guarantees of future performance and some of them will inevitably prove to be incorrect. As a result, our actual future results can be expected to differ from our expectations, and those differences could be material.

Company Metrics and Conference Call

2017 Company metrics, updated to include the fourth quarter, is available at http://investor.stamps.com (under a tab on the left side called Company Information, Metrics). These metrics are not incorporated into this press release.

The Stamps.com financial results conference call will be webcast today at 5:00 p.m. Eastern Time and may be accessed at http://investor.stamps.com. The Company plans to discuss its business outlook during the conference call. Following the conclusion of the webcast, a replay of the call will be available at the same website.

About Stamps.com, Endicia, ShipStation, ShipWorks and ShippingEasy

Stamps.com (Nasdaq: STMP) is the leading provider of postage online and shipping software solutions to over 725 thousand customers, including consumers, small businesses, e‑commerce shippers, enterprises, and high volume shippers. Stamps.com offers solutions that help businesses run their shipping operations more smoothly and function more successfully under the brand names Stamps.com, Endicia, ShipStation, ShipWorks and ShippingEasy. Stamps.com’s family of brands provides seamless access to mailing and shipping services through integrations with more than 450 unique partner applications.

Endicia is a leading brand for high volume shipping technologies and services for U.S. Postal Service shipping. Under this brand we offer solutions that help businesses run their shipping operations more smoothly and function more successfully. Our Endicia branded solutions also provide seamless access to USPS shipping services through integrations with partner applications.

ShipStation is a leading web‑based shipping solution that helps e‑commerce retailers import, organize, process, package, and ship their orders quickly and easily from any web browser. ShipStation features the most integrations of any e‑commerce web‑based solution with more than 175 shopping carts, marketplaces, package carriers, and fulfillment services. Integration partners include eBay, PayPal, Amazon, Etsy, Square, Shopify, BigCommerce, Volusion, Magento, Squarespace, and carriers such as USPS, UPS, FedEx and DHL. ShipStation has sophisticated automation features such as automated order importing, custom hierarchical rules, product profiles, and fulfillment solutions that enable its customers to complete their orders, wherever they sell, and however they ship.

ShipWorks is a leading brand for client‑based shipping solutions that help high volume shippers import, organize, process, fulfill, and ship their orders quickly and easily from any standard PC. With integrations to more than 100 shopping carts, marketplaces, package carriers, and fulfillment services, ShipWorks has the most integrations of any high‑volume client shipping solution. Package carriers include USPS, UPS, FedEx, DHL, OnTrac and many more. Marketplace and shopping cart integrations include eBay, PayPal, Amazon, Etsy, Shopify, BigCommerce, Volusion, ChannelAdvisor, Magento, and many more. ShipWorks has sophisticated automation features such as a custom rules engine, automated order importing, automatic product profile detection, and fulfillment automation, which enable high volume shippers to complete their orders quickly and efficiently.

ShippingEasy is a leading web‑based shipping software solution that allows online retailers and e‑commerce merchants to organize, process, fulfill and ship their orders quickly and easily. ShippingEasy integrates with leading marketplaces, shopping carts, and e‑commerce platforms to allow order fulfillment and tracking data to populate in real time across all systems. The ShippingEasy software downloads orders from selling channels and automatically maps custom shipping preferences, rates and delivery options across all supported carriers.

About Non‑GAAP Financial Measures

To supplement the Company’s condensed consolidated balance sheet and consolidated statement of income presented in accordance with GAAP, the Company uses non‑GAAP measures of certain components of financial performance. These non‑GAAP measures include non‑GAAP income from operations, non‑GAAP adjusted income, non‑GAAP adjusted income per fully diluted share and adjusted EBITDA.

Non‑GAAP financial measures are provided to enhance investors’ overall understanding of the Company’s financial performance and prospects for the future and as a means to evaluate period‑to‑period comparisons. The Company believes the non‑GAAP measures that: (1) exclude certain non‑cash items including stock‑based compensation expense, amortization of acquired intangibles, amortization of debt issuance costs, contingent consideration charges; (2) exclude certain expenses and gains such as acquisition related expenses, litigation settlement expenses, executive consulting expenses, insurance proceeds; and (3) includes income tax adjustments provide meaningful supplemental information regarding financial performance by excluding certain expenses and benefits that may not be reflective of our underlying operating performance. Non‑GAAP adjusted income is calculated as GAAP net income plus the cumulative impact of the adjustments outlined above. Non‑GAAP adjusted income per fully diluted share is calculated as non‑GAAP adjusted income divided by fully diluted shares. Prior to the third quarter 2016, the Company referred to non‑GAAP adjusted income as non‑GAAP net income.

Non‑GAAP income tax expense for the first, second and third quarters of our fiscal year are calculated by multiplying the projected annual effective tax rate in that quarter by the non‑GAAP adjusted income before taxes for the quarter. The projected annual effective tax rate does not reflect potential future employee option exercises in the remaining quarters of the fiscal year due to the inherent difficulty in forecasting employee option exercises. The projected annual effective tax rate also considers other factors including the Company’s tax structure and its tax positions in various jurisdictions where the Company operates. The actual annual effective tax rate realized for the fiscal year could differ materially from our projected annual effective tax rate used in the first, second and third quarters.

Non‑GAAP income tax expense for the fourth quarter of the fiscal year is calculated by multiplying the actual effective tax rate for the fiscal year by the non‑GAAP adjusted income before taxes for the fiscal year and subtracting the non‑GAAP income tax expense or benefit reported in the first, second and third quarters. As a result, the fourth quarter reflects the tax impact of reconciling the first, second and third quarter projected annual effective rates to the actual effective tax rate for the fiscal year.

The calculations described above reflect the methodology used for calculating non‑GAAP income tax expenses in reported results for 2017. For 2016 reported results, the Company used a different methodology for calculating non‑GAAP income tax expense that reflected the Company’s ability to use its remaining tax assets such as net operating losses and other tax credits. The reason for the change in methodology was that the Company had utilized substantially all of its net operating losses and other tax credits by the end of 2016. In order to help investors better understand the impact of the change in methodology, the Company previously provided recast non‑GAAP income tax expense for 2016 showing what the non‑GAAP income tax expense would have been under the 2017 methodology. The Company expects that the non‑GAAP income tax expense methodology for 2018 will be consistent with the 2017 methodology. As a result, the Company believes it is no longer necessary to provide recast non‑GAAP income tax expenses.

Adjusted EBITDA as calculated in this earnings release represents earnings before interest and other expense, net, interest and other income, net, income tax expense or benefit, depreciation and amortization and excludes certain items, such as stock‑based compensation expense, described in this release used to reconcile GAAP to non‑GAAP income from operations.

The presentation of non‑GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. These non‑GAAP financial measures may differ from similarly titled measures used by other companies. Reconciliation of non‑GAAP financial measures included in this earnings release to the corresponding GAAP measures can be found in the financial tables of this earnings release.

The Company believes that non‑GAAP financial measures, when viewed with GAAP results and the accompanying reconciliation, enhance the comparability of operating results against prior periods and allow for greater transparency of operating results. Management uses non‑GAAP financial measures in making financial, operating, compensation and planning decisions. The Company believes non‑GAAP financial measures facilitate management and investors in comparing the Company’s financial performance to that of prior periods as well as in performing trend analysis over time.

Share Repurchase Timing

The timing of share repurchases, if any, and the number of shares to be bought at any one time will depend on factors including market conditions and the Company’s compliance with the covenants in its Credit Agreement. Share repurchases may be made from time to time on the open market or in negotiated transactions at the Company’s discretion in compliance with Rule 10b‑18 of the United States Securities and Exchange Commission. The Company’s purchase of any of its shares may be subject to limitations imposed on such purchases by applicable securities laws and regulations and the rules of the Nasdaq Stock Market.

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995

This release includes “forward‑looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.Forward‑looking statements are statements that are not historical facts, and may relate to future events or the company’s anticipated results, business strategies or capital requirements, among other things, all of which involve risks and uncertainties. You can identify many (but not all) such forward‑looking statements by looking for words such as “approximates,” “believes,” “expects,” “anticipates,” “estimates,” “projects,” “seeks,” “intends,” “plans,” “could,” “would,” “may” or other similar expressions.Important factors, including the Company’s ability to successfully integrate and realize the benefits of its past or future strategic acquisitions or investments, to complete and ship its products and to maintain desirable economics for its products, as well as the timing of when the Company will utilize its deferred tax assets, and obtain or maintain regulatory approval, which could cause actual results to differ materially from those in the forward‑looking statements, are detailed in filings with the Securities and Exchange Commission made from time to time by Stamps.com, including its Annual Report on Form 10‑K for the year ended December 31, 2016, Quarterly Reports on Form 10‑Q, and Current Reports on Form 8‑K.Matters described in forward‑looking statements may also be affected by other known and unknown risks, trends, uncertainties and factors, many of which are beyond the company’s ability to control or predict. Stamps.com undertakes no obligation to release publicly any revisions to any forward‑looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Trademarks

Stamps.com, the Stamps.com logo, Endicia, ShipStation, ShipWorks, and ShippingEasy are registered trademarks of Stamps.com Inc. and its subsidiaries. All other brands and names used in this release are the property of their respective owners.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20180503006429/en/

Source: Stamps.com

Stamps.com

Investor:

Suzanne Park

Investor Relations

(310) 482‑5830

[email protected]

or

Press:

Eric Nash

Public Relations

(310) 482‑5942

[email protected]