STAMPS.COM ANNOUNCES THIRD QUARTER 2010 RESULTS

Non-GAAP Diluted Earnings Per Share of $0.24, highest in the Company’s History

LOS ANGELES – October 28, 2010 – Stamps.com® (Nasdaq:STMP), the leading provider of postage online and shipping software solutions, today announced results for the third quarter ended September 30, 2010.

For the third quarter:

- Excluding the enhanced promotion channel, PC Postage revenue was $18.2 million, up 8% from the third quarter of 2009.

- Total PC Postage revenue including the enhanced promotion channel (which consists of online programs where additional promotions are provided directly by marketing partners) was $19.2 million, up 5% from the third quarter of 2009.

- PhotoStamps revenue was $1.4 million, down 24% compared to the third quarter of 2009.

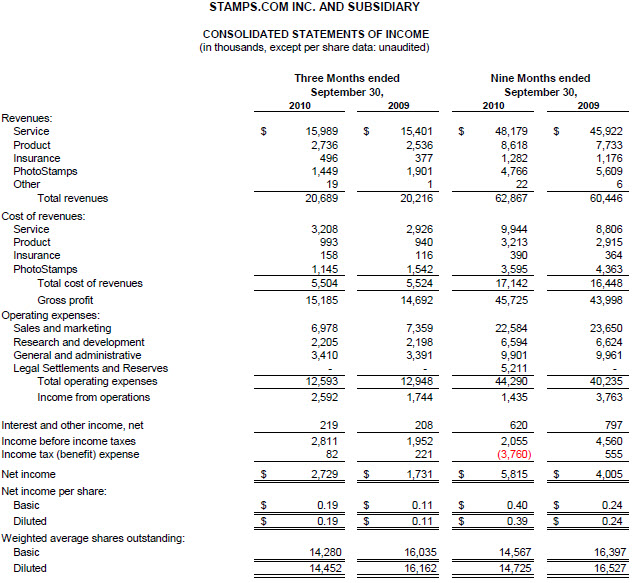

- Including the decline in PhotoStamps, total revenue was $20.7 million, up 2% compared to the third quarter of 2009.

- PC Postage gross margin was 77.3%, PhotoStamps gross margin was 21.0% and total gross margin was 73.4%.

- GAAP net income was $2.7 million, or $0.19 per fully diluted share. This includes $0.8 million stock-based compensation expense.

- Excluding the stock-based compensation expense, non-GAAP income from operations was $3.4 million, non-GAAP net income was $3.5 million and non-GAAP net income per fully diluted share was $0.24.

“For the quarter, our non-GAAP earnings per share was up by 44%, and this was the highest level of quarterly non-GAAP earnings per share we have generated in the Company’s history,” said Ken McBride, Stamps.com president and CEO. “We continue to see good results across the board, including our non-enhanced promotion SOHO business, our enterprise area, and our high volume shipping area. As a result of the strength in our businesses, we raised our 2010 Non-GAAP EPS guidance again today.”

Third quarter 2010 Detailed Results

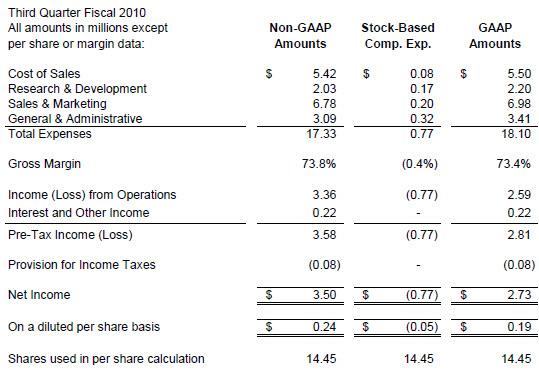

Stamps.com reported 2010 third quarter GAAP net income of $2.7 million. On a per share basis, total 2010 third quarter GAAP net income was $0.19 based on fully diluted shares outstanding of 14.5 million. Third quarter GAAP net income was reduced by $0.8 million for stock-based compensation expense. The $0.8 million stock-based compensation expense was allocated among cost of sales, research and development, sales and marketing, and general and administrative as shown in the following table:

Excluding the stock-based compensation expense, 2010 third quarter non-GAAP net income was $3.5 million or $0.24 per fully diluted share based on fully diluted shares outstanding of 14.5 million. This compares to 2009 third quarter non-GAAP net income of $2.7 million and non-GAAP net income per fully diluted share of $0.17. Thus, non-GAAP third quarter diluted earnings per share increased by 44% compared to the same quarter last year.

Dividend

In a separate release today, the Stamps.com Board of Directors announced that it has declared a one-time special dividend of $2.00 per share payable to shareholders of record as of the close of business on November 11, 2010, to be paid on December 2, 2010.

Share Repurchase

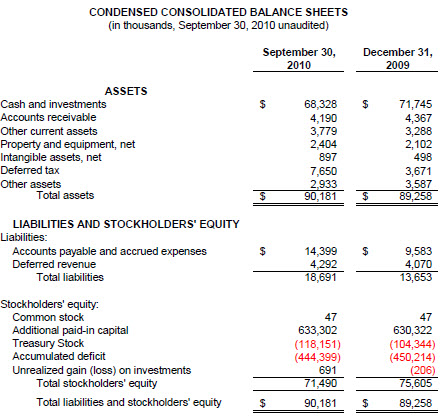

Over the past four quarters, the Company has repurchased a total of 1.7 million shares for a total cost of $15.0 million. During the third quarter, the Company repurchased a total of 87 thousand shares for a total cost of $0.9 million. The Company’s current repurchase plan remains in effect through February of 2011 with a remaining authorization of approximately 2 million shares.

The timing of share purchases, if any, and the number of shares to be bought at any one time will depend on market conditions and also will depend on the Company’s assessment of risk that its net operating loss asset could be impaired if such a repurchase were undertaken. Share purchases may be made from time-to-time on the open market or in negotiated transactions at the Company’s discretion in compliance with Rule 10b-18 of the United States Securities and Exchange Commission. The Company’s purchase of any of its shares may be subject to limitations imposed on such purchases by applicable securities laws and regulations and the rules of the Nasdaq Stock Market.

Net Operating Loss (NOL) Protective Measures Are Suspended

Stamps.com currently has approximately $220 million in Federal NOLs and $140 million in State NOLs. The Company estimates that as of September 30, 2010, its ownership shift was approximately 22% compared with the 50% level that could trigger impairment of its NOL asset under Internal Revenue Code Section 382 rules. As a result of the decline in the ownership shift, the Board of Directors suspended the NOL Protective Measures by approving a waiver, effective July 22, 2010, from the NOL Protective Measures to all persons and entities, including companies and investment firms. As a result, shareholders of the Company are allowed to become 5% shareholders and existing 5% shareholders are allowed to make additional purchases of the Company’s stock.

Business Outlook

Stamps.com currently expects total 2010 revenue to be $80 to $90 million. 2010 GAAP net income per share is expected to be $0.20 to $0.40, including approximately $3.0 million of stock-based compensation expense, $5.2 million of legal settlements and reserves, $4.0 million non-cash tax benefit and approximately $3.0 million of expenses associated with the special dividend and its impact on employee stock options. Excluding the stock-based compensation expense, legal settlements and reserves, tax benefits and expenses associated with the special dividend, non-GAAP 2010 net income per fully diluted share is expected to be $0.70 to $0.90. This compares to previous expectations for non-GAAP 2010 net income per fully diluted share of $0.65 to $0.85 and original guidance given in February 2010 of $0.50 to $0.70.

Company Customer Metrics

A complete set of the quarterly customer metrics for the past four fiscal years and current fiscal year to date is available currently at http://investor.stamps.com (under a tab on the left side called Company Information, Metrics).

Quarterly Conference Call

The Stamps.com financial results conference call will be web cast today at 5:00 p.m. Eastern Time and may be accessed at http://investor.stamps.com. The Company plans to discuss its business outlook during the conference call. Following the conclusion of the web cast, a replay of the call will be available at the same website.

About Stamps.com and PhotoStamps

Stamps.com (Nasdaq: STMP) is a leading provider of Internet-based postage services. Stamps.com’s service enables small businesses, enterprises, advanced shippers, and consumers to print U.S. Postal Service-approved postage with just a PC, printer and Internet connection, right from their home or office. The Company currently has PC Postage partnerships with Avery Dennison, Microsoft, HP, Office Depot, the U.S. Postal Service and others.

PhotoStamps is a patented Stamps.com product that couples the technology of PC Postage with the simplicity of a web-based image upload and order process. Customers may create full custom PhotoStamps with their own digital photograph, or they may choose a licensed image from one of many PhotoStamps collections such as the collegiate collection. Since launching PhotoStamps in May 2005, more than 82 million individual PhotoStamps have been shipped to customers. Stamps.com currently has PhotoStamps partnerships with Apple, Google/Picassa, HP/Snapfish, Adobe and others.

Non-GAAP Measures

To supplement the Company’s condensed financial statements presented in accordance with GAAP, Stamps.com uses non-GAAP measures of certain components of financial performance. These non-GAAP measures include non-GAAP income from operations, non-GAAP pre-tax income, non-GAAP net income, non-GAAP earnings per diluted share, and non-GAAP gross margin. Reconciliation to the nearest GAAP measures of all non-GAAP measures included in this press release can be found in the financial tables on page 2 of this press release.

Non-GAAP measures are provided to enhance investors’ overall understanding of the Company’s current financial performance, prospects for the future and as a means to evaluate period-to-period comparisons. The Company believes that these non-GAAP measures provide meaningful supplemental information regarding financial performance by excluding certain expenses and benefits that may not be indicative of recurring core business operating results. The Company believes the non-GAAP measures that exclude stock-based compensation, asset write-downs, legal charges and income tax adjustments, when viewed with GAAP results and the accompanying reconciliation, enhance the comparability of results against prior periods and allow for greater transparency of financial results. The Company believes non-GAAP measures facilitate management’s internal comparison of the Company’s financial performance to that of prior periods as well as trend analysis for budgeting and planning purposes. The presentation of non-GAAP measures are not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This release includes forward-looking statements about our anticipated results that involve risks and uncertainties. Important factors, including the Company’s ability to complete and ship its products, maintain desirable economics for its products and obtain or maintain regulatory approval, which could cause actual results to differ materially from those in the forward-looking statements, are detailed in filings with the Securities and Exchange Commission made from time to time by STAMPS.COM, including its Annual Report on Form 10-K for the year ended December 31, 2009, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. STAMPS.COM undertakes no obligation to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Stamps.com, the Stamps.com logo and PhotoStamps are trademarks or registered trademarks of Stamps.com Inc. All other brands and names are property of their respective owners.

Stamps.com Investor Contact:

Stamps.com Investor Relations

(310) 482-5830

http://investor.stamps.com

Press Contact:

Brew PR

(310) 600-7160

[email protected]